Introduction

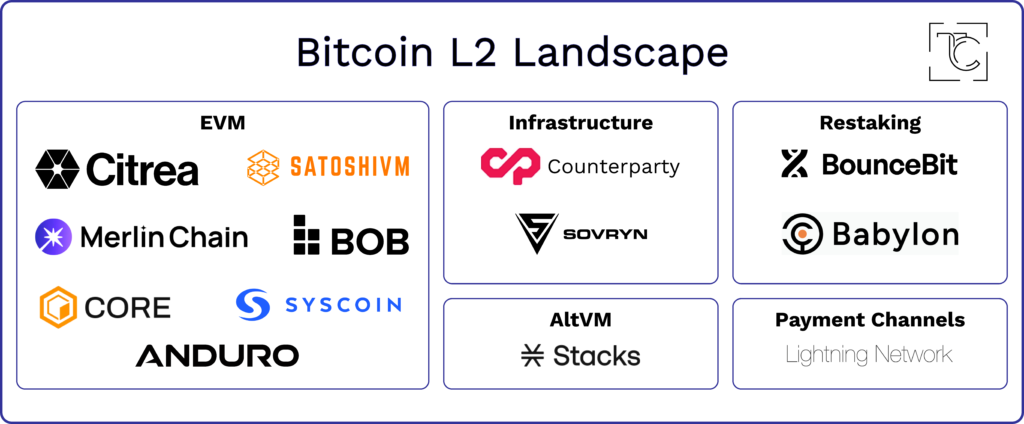

The Lightning network, a protocol based on bidirectional payment channels, has been seen as the premier scaling solution for several years now, but its design based on payment channels suffers from structural liquidity fragmentation, and as a result is fundamentally unworkable at this time. Growth on the protocol has been slow, with only about $330M locked in Lightning channels. Setting up and operating a well-connected Lightning node is a very involved process, and as a result virtually all traffic flows through centralized intermediaries. While Lightning may have certain niche use cases in the long run, it’s broadly unsuitable for even the level of adoption that Bitcoin has today.

That said, several new alternative L2s are emerging that are instead based on the same all-to-all payment principals as Bitcoin’s base layer, with many offering greater expressiveness than the base layer. L2s for Bitcoin are an old idea, but novel designs with better security guarantees than classic sidechains are receiving more and more attention. We’re now seeing the development of a large number of competing frameworks, many enabled by the Taproot network upgrade and BitVM, a general computation framework on Bitcoin.

Given the amount of idle capital on Bitcoin and the potential they offer for yield generation and ecosystem enlargement, some of these new protocols are worth paying attention to—whether for the sake of investing in any existing or future tokens that the protocols may offer or for their potential to act as sinks in the circulating supply of BTC.

Our goal with this article is to give a brief overview of some of the most prominent projects and protocols working on scaling Bitcoin, with a focus on those that offer or are likely to offer investable tokens. While far from a comprehensive overview, we hope it serves as a strong starting point for researchers in the space and offers some insight into our thought process when assessing potential investment opportunities.

Oldcoins

Stacks

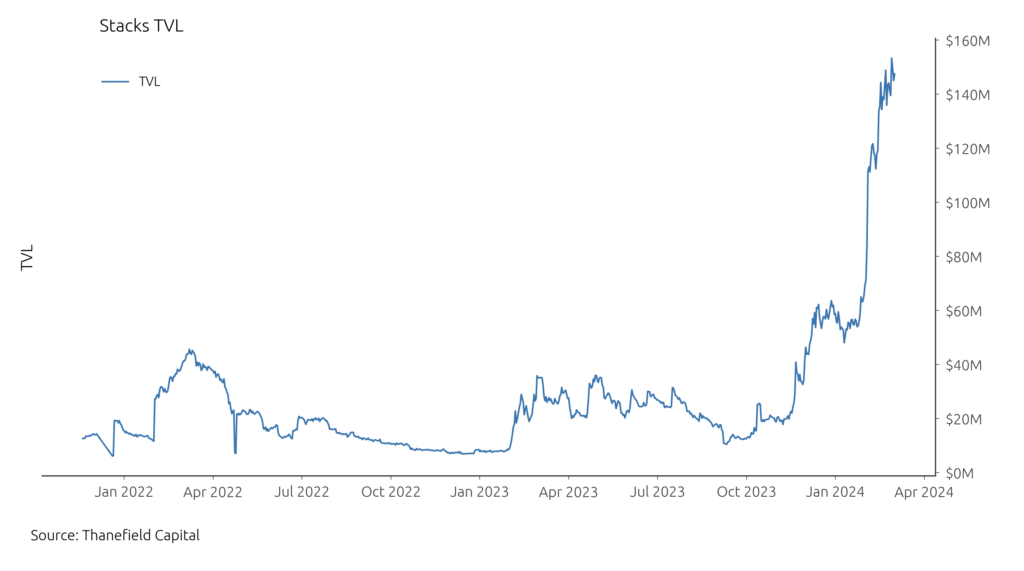

Stacks is the largest general-purpose smart contract platform built on top of Bitcoin and one of the few currently live on mainnet. As such, it warrants extended discussion compared to other projects.

While Stacks is often characterized as a Bitcoin L2, its primary gas token at the moment is STX, not BTC, and its capabilities are somewhat constrained compared to Ethereum L2s. Stacks has been under development since 2013 and raised capital through an SEC-registered token sale in 2019.

Stacks’ main intended value proposition is turning BTC into a productive asset by building a vibrant DeFi ecosystem around BTC on the Stacks network. There have been two main challenges for Stacks to deliver on this vision. First, the absence of a trust-minimized bridge between the Bitcoin network and Stacks means that BTC bridged to Stacks is arguably not more secure than BTC bridged to other networks in a trusted manner (for instance, WBTC on Ethereum). The second challenge is the block time—at the moment, Stacks blocks are synchronized with Bitcoin’s, meaning sometimes users have to wait for up to an hour for transactions to confirm. That leaves the Stacks network with poor user experience and unclear competitive advantage over other networks.

Stacks’ Nakamoto upgrade, slated for inclusion in about one month, is the most significant one since the network was launched and tackles both aforementioned problems, among others. Following the upgrade, which is already live in the testnet and expected to hit the mainnet in April, Stacks will have sBTC—a trustless two-way Bitcoin peg system, which inherits the security of native BTC. It’s likely that the presence of a BTC-pegged coin will attract relatively significant TVL, and sBTC could dethrone STX as the most widely used token on Stacks over time. One of the recent proposals on the governance forum discusses enabling sBTC as a gas asset on Stacks. The other major improvement is the reduction of block time to approximately 5 seconds. Hence, the Nakamoto upgrade is a game-changer for the Stacks ecosystem as it enables new types of applications that require faster block times, as well as improves the security model of BTC on Stacks, arguably its main value proposition.

Even with limited usability due to the reasons described above, the Stacks ecosystem has been growing. Ecosystem participants include ALEX, whose team has built a DEX, a bridge, and a launchpad on Stacks, and which is currently responsible for about 60% of the total Stacks TVL, according to DeFiLlama. Other projects in the ecosystem include Gamma, an NFT marketplace, StackingDAO, a liquid staking project that quickly rose to a $50M TVL, and Bitflow, a stableswap protocol with about $25M in TVL. Velar, a perp DEX building on top of Stacks, recently raised a $3.5M funding round, a development that started happening more often in the ecosystem.

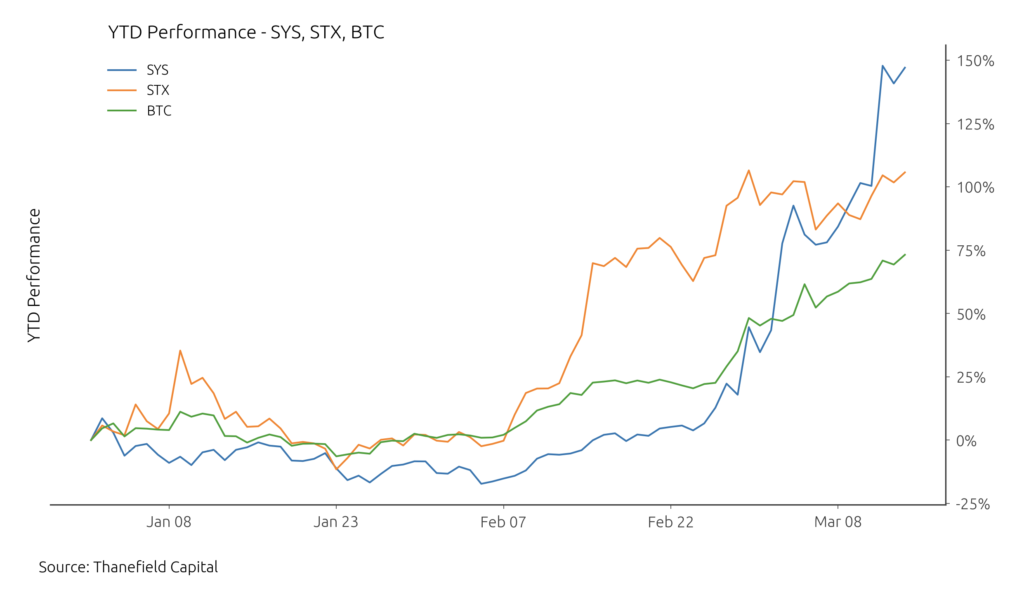

Along with the Nakamoto upgrade, the Bitcoin halving could serve as a catalyst for STX. The token’s recent outperformance is likely due in part to front-running these events. At around a $5.4B FDV, STX is priced at 20% to 25% of the FDV of ARB and OP, the leading Ethereum L2s, although it has a comparable market capitalization.

Along with the Nakamoto upgrade, the Bitcoin halving could serve as a catalyst for STX. The token’s recent outperformance is likely due in part to front-running these events. At around a $5.4B FDV, STX is priced at 20% to 25% of the FDV of ARB and OP, the leading Ethereum L2s, although it has a comparable market capitalization.

Syscoin

Syscoin is another older project, with its token (SYS) trading since 2014. While the product is very old, it is still under active development. Syscoin is merge-mined with Bitcoin, and the team is also developing Rollux, an optimistic EVM rollup built on OP Stack. Similarly to Stacks, Rollux uses SYS, not BTC, as its gas token, but inherits some security properties from the Bitcoin chain.

While much smaller than STX, at about a $257M FDV, SYS is notable among the older trading Bitcoin tokens for having a relatively liquid market on Binance and other centralized exchanges, with a global daily volume of about $23M. This liquidity makes it potentially actionable from an investment standpoint in a way that few Bitcoin L2s from that vintage are. Year-to-date, SYS has significantly outperformed both BTC and STX.

While much smaller than STX, at about a $257M FDV, SYS is notable among the older trading Bitcoin tokens for having a relatively liquid market on Binance and other centralized exchanges, with a global daily volume of about $23M. This liquidity makes it potentially actionable from an investment standpoint in a way that few Bitcoin L2s from that vintage are. Year-to-date, SYS has significantly outperformed both BTC and STX.

Others

In addition to STX and SYS, there are a large number of Bitcoin L2 tokens from previous market cycles. For the most part, these are highly illiquid, but some merit mention for their role in the development of the ecosystem, or because they were previously prominent. These include Counterparty (XCP), Omni (OMNI), and Sovryn (SOV).

Newcoins

Merlin

Merlin Chain is an EVM-compatible ZK rollup for Bitcoin-native assets, under development by Bitmap Tech. The chain is based on Polygon CDK, uses BTC Connect to support both Bitcoin and EVM wallets, and relies on a centralized sequencer. The team announced a private funding round from OKX Ventures and Foresight Ventures in February, followed by the launch of the network’s mainnet two weeks later, in which assets are custodied in a single-signature address.

The primary way to gain exposure to Merlin chain is through its staking program, Merlin’s Seal, whose participants will receive 20% of the total MERL supply on TGE in April. Participants can stake assets on both the Bitcoin and Ethereum chains to earn points, which will be converted to MERL in March. Stakers cannot withdraw until around the halving in April. At the time of writing, the program has attracted $3.8B in staked assets, a considerable sum.

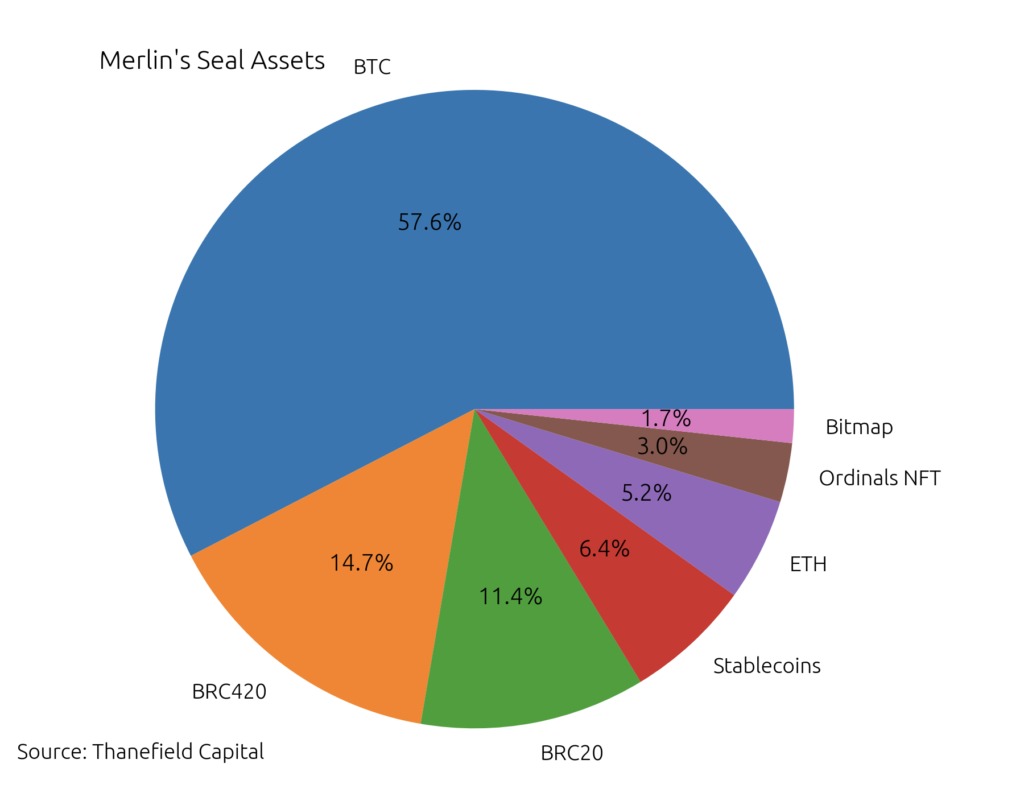

Out of the $3.8B in assets locked in Merlin’s Seal, Bitcoin accounts for 57%, followed by BRC420 and BRC20 that together total up to $1B—or roughly 26%. Ordinals NFTs, ETH, and stablecoins account for smaller percentages.

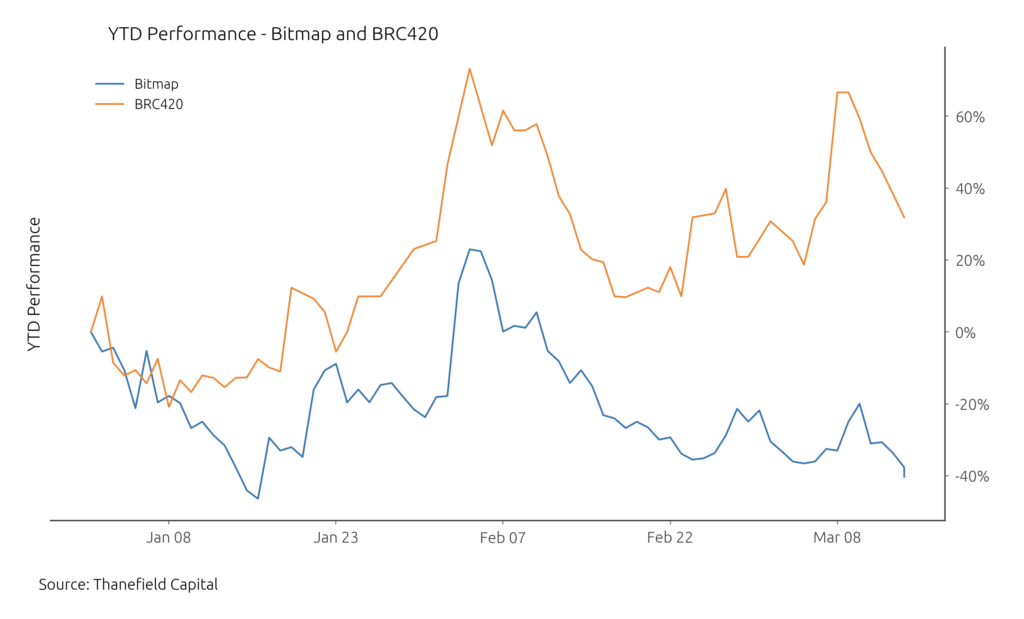

Merlin Chain was developed by Bitmap Tech, which also developed Blue Box (BRC-420) and Bitmap, two major ordinal collections with a combined market capitalization of $690M. Year-to-date, Blue Boxes and Bitmaps have seen contrasting performances, with Blue Boxes appreciating by 32% and Bitmaps declining by 36%. Blue Boxes’ outperformance can be attributed to their more favorable tokenomics and status as the developer’s premier collection.

Merlin Chain was developed by Bitmap Tech, which also developed Blue Box (BRC-420) and Bitmap, two major ordinal collections with a combined market capitalization of $690M. Year-to-date, Blue Boxes and Bitmaps have seen contrasting performances, with Blue Boxes appreciating by 32% and Bitmaps declining by 36%. Blue Boxes’ outperformance can be attributed to their more favorable tokenomics and status as the developer’s premier collection.

Accordingly, Blue Boxes are positioned as the primary vehicle for liquid exposure to Merlin Chain ahead of TGE, essentially serving as an indirect proxy for the network’s token. Despite being one of the largest collections on Bitcoin, Bitmaps are less attractive from an investment perspective due to their high supply and inflationary model. Another highly speculative way to get indirect exposure to MERL is through the network’s main meme coins, VOYA and HUHU, which have also appreciated significantly in anticipation of the token’s launch.

Another highly speculative way to get indirect exposure to MERL is through the network’s main meme coins, VOYA and HUHU, which have also appreciated significantly in anticipation of the token’s launch.

Finally, while the MERL token has not officially launched, it’s possible to get a rough idea of how the market is pricing it by looking at pre-market trading activity from Whales Market, an OTC trading platform that allows users to speculate on the price of upcoming tokens and purchase airdrop allocations and points. While liquidity is very thin, the mid price for pre-market MERL tokens is $2.7, yielding an implied $5.7B FDV.

Citrea

Citrea, which is being developed by the Chainway Labs team, is an optimistic EVM rollup on Bitcoin with zero-knowledge fraud proofs. The current implementation relies on a centralized sequencer, who periodically submits a merkle root of the L2’s transactions and a RISC Zero-based zk-STARK proof of the state’s validity. In case of dishonesty by the sequencer, users can challenge the proof submission.

This differs somewhat from Ethereum-based ZK rollups like zkSync and Scroll, which operate pessimistically, with the sequencer being unable to submit an invalid state to the mainnet in the first place. These different design decisions result from from constraints in the computational capabilities of Bitcoin and BitVM.

Citrea also features a bridge based on a multisig with a 1-of-N honesty assumption. This design offers the best security guarantees currently afforded by BitVM.

The project recently raised a $2.3 million seed round, and has not yet launched a public testnet.

Babylon

Babylon is a protocol that allows L2s to offload security to a validator set composed of Bitcoin stakers. Stakers receive altcoin emissions and fees from the sidechains, and are slashed for misbehavior. The slashing procedure relies Extractable One Time Signatures, which leak the validator’s private keys in cases of attempted double-signing, allowing anyone to burn their staked coins. The protocol is based on the Cosmos SDK, with a central hub called Babylon chain coordinating staking procedures.

The protocol is most analogous to Eigenlayer on Ethereum. However, due to Bitcoin’s proof of work nature, stakers don’t receive native BTC rewards.

The project raised a $18 million round in December and is currently live on testnet.

BOB

BOB, which stands for Build on Bitcoin, is a general-purpose L2 stack on Bitcoin that relies on the EVM for smart contract execution, ensuring compatibility with existing Ethereum tools and infrastructure. BOB’s stack includes a rollup layer capable of integrating with any EVM-compatible rollup or chain, with an initial launch on the OP stack and plans to improve it with RiscZero’s ZK technology in the future.

A unique feature of BOB is its merged mining protocol, which allows for the integration of Bitcoin’s security features. BOB plans to offer seamless Bitcoin integration through trustless bridges and a BTC light client, enabling direct interaction with BTC transactions and assets within its ecosystem. Furthermore, BOB will support Rust-based Bitcoin applications and SDKs, with plans to incorporate zkVM technology for off-chain Rust execution verifiable via ZK proofs in EVM smart contracts.

Finally, BOB provides an SDK akin to OpenZeppelin in the EVM world, which includes Solidity contracts that can interact with the BTC ecosystem infrastructure, such as Ordinals, BRC20s, and others.

Currently, BOB is live on a public testnet.

Others

Several other Bitcoin L2s have also recently issued tokens. The most notable of these are Core (CORE), which currently trades at a $570M market capitalization and a $1.3B valuation and has several CEX listings, most notably OKX, and SatoshiVM (SAVM), with a $49M market cap and a $72M FDV.

There are also a substantial number of other projects currently in earlier stages of development, including several in stealth; Anduro, an L2 framework under incubation by Marathon; and BounceBit, a Bitcoin restaking project founded by Jack Lu that has raised $6M and is currently live on testnet, with an invite-only staking program on mainnet.

Closing Thoughts

Since the bulk of the technology employed by this sector was only made possible by Taproot, most of these projects are in a relatively early stage of development, especially when compared to analogous projects on Ethereum. Potential upside is therefore high, especially in light of the upcoming halving and current Bitcoin-led market, both of which should direct attention toward projects building on Bitcoin. As a result, we’re thematically bullish on this sector, and will continue to monitor upcoming developments and explore new liquid opportunities as they arise.