Historically, halving cycles have profoundly incited price speculation, spawning predictions that span the entire bull-to-bear spectrum. Our goal with this piece is to clear up some common misconceptions and offer an objective take based on our familiarity with Bitcoin mining dynamics. To do so, we’ll assess the scale of miner flows from first principles, looking at both on-chain data and production updates from public miners.

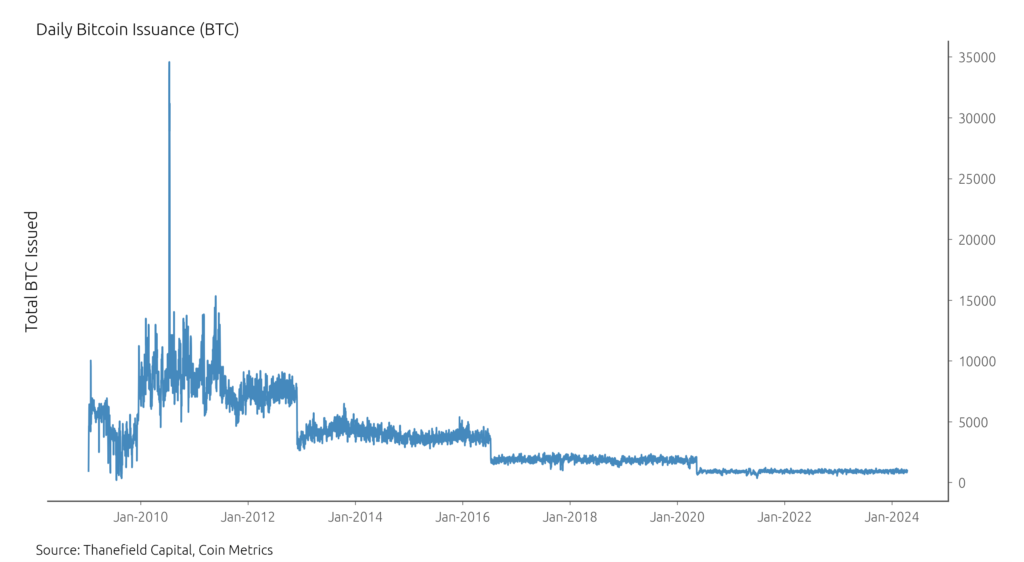

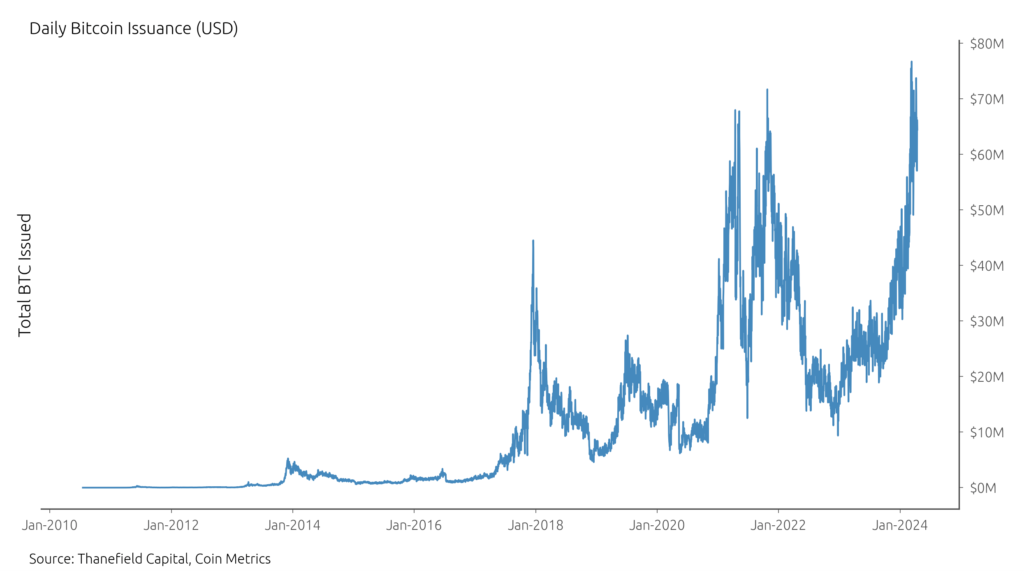

Miners have been major actors in the Bitcoin ecosystem since the genesis block, and are crucial to the continued functioning of the network. Yet their economic relevance is programmed to shrink over time: every halving cycle, emissions are reduced, and while fees may pick up the slack in the future, so far this has led to a decrease in BTC-denominated miner revenue with each halving cycle.

In other words, miners matter a lot less than they used to. While there are both bullish and bearish considerations with the halving, we believe that the impact of the raw miner flows (as separated from memetics) will ultimately be more subdued this time around as compared to last cycle.

The (Long-Term) Bull Argument

In its most limited form, the bull argument is roughly the following:

Miners are net sellers of BTC, and new emissions being sold into the market is bad for price. The halving of emissions reduces this persistent sell pressure, which has a positive impact on price in the medium to long run.

Without opining extensively on whether or not this reduction in flows has already been priced in, we’re sympathetic to this argument. That said, the perceived impacts on the market may not be as dramatic as many anticipate due to both the magnitude of the flows and current mining economics.

Bitcoin’s current emissions of 6.25 BTC/block are scheduled to be reduced to 3.125 BTC/block. This corresponds to about 900 BTC/day and 450 BTC/day, respectively, assuming consistent ten minute block times. In practice, these emissions are slightly higher, averaging 917 BTC/day over the last 30 days, since blocks have historically averaged under ten minutes due to hashrate generally increasing over time.

At the current bitcoin price of about $68,000, this comes out to a pre-and-post halving theoretical value of about $61.2M and $30.6M in emissions per day, with this figure again being slightly higher in practice.

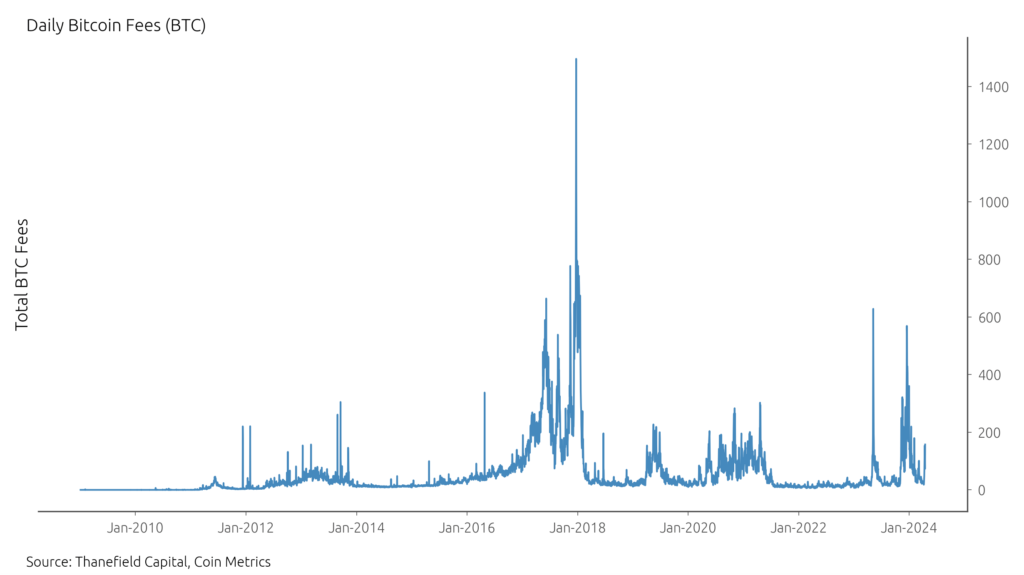

The other component of miner revenue is fees. While these have once again become significant in a post-ordinals world, they’re still not a reliable source of revenue due to fee volatility. In the past 30 days, network-wide fees have averaged at 46 BTC/day. Apart from increased activity due to the launch of runes, this component of miner revenue should be unaffected by the halving.

Summing up the revenue from both fees and emissions, miners earned about 963 BTC/day in the last 30 days, or about $65M/day. While most people assume that all these coins hit the market and create a drag on price, this oversimplifies the dynamics associated with mining economics.

Estimating the percentage of coins sold is difficult, but we can ballpark operational costs to determine a floor on spending. At the current network hashrate of 630 EH, using Coin Metrics’ estimated network-wide average efficiency of 31.4 J/TH, and assuming a generous all-in power cost of 6¢/kWh, we can arrive at a baseline forced sell pressure of about $28M/day.

Under current market conditions, even under the assumption of no change in network hashrate, a vanilla S19—now a fairly dated model—should be marginally profitable at a 6¢/kWh power cost. Because Bitcoin’s ASIC distribution skews toward newer models, even assuming that all machines less efficient than the S19 fall offline would only result in a 21% reduction in hashrate. In reality, many of these less efficient machines operate on sites with very low power costs or where capital flight is a priority over economics, and will prove robust to the halving.

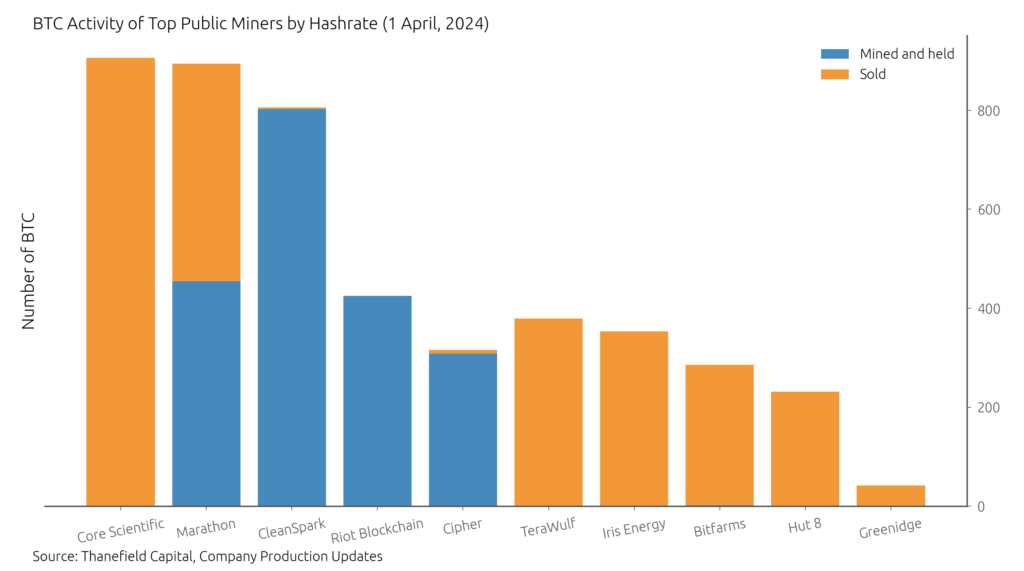

Apart from forced selling to cover costs, miners also sell coins to pay for expansion and machine upgrades, as well as to lock in profits. Among the top 10 miners, about 57% of coins mined in March were sold.

Extrapolating this out to the network, which only forms a rough ballpark estimation due to differing shareholder requirements and access to capital, results in about $37.3M of total sell pressure from miners with BTC at $68,000. In the future, this data can be compared to on-chain flow data to arrive at a more reliable estimate for aggregate miner selling.

Although small, if not already priced in, the halving-induced reduction in sell pressure is structurally bullish in the long run. Seen from another angle, though, this drop in persistent sell pressure comes out of miners’ margins, which forms the basis for the short-term bear thesis.

The (Short-Term) Bear Argument

The bear argument is roughly along these lines:

The reduction in rewards caused by the halving will drive less efficient miners out of business. In the process of unwinding operations, these miners will liquidate their bitcoin inventories. This sell pressure will negatively impact price in the short term.

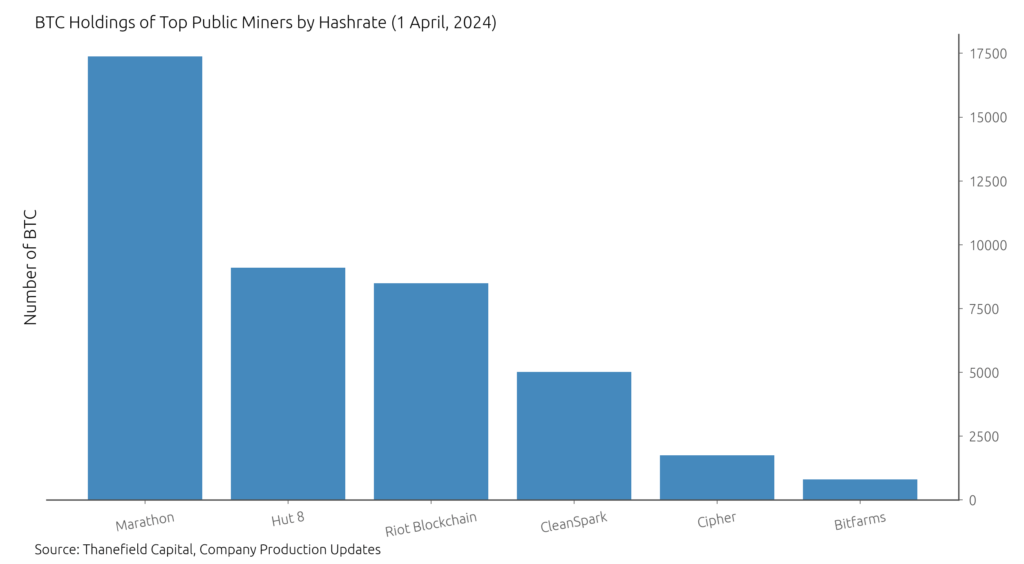

While the bear argument is fundamentally sound, the scale of the selling will be much smaller than its proponents believe it to be. Subscribers to this line of thinking argue that miners hold millions of coins that could potentially be liquidated, there’s nuance to this: in reality, the majority of these coins are held by early whales who are no longer actively mining and are not subject to the same competitive pressures as most miners.

To get an idea of how many coins are held by active miners, we can look at data from the top public miners, which comprised about 16% of network hashrate, and in total held 42,541 BTC.

A cursory extrapolation from this figure would place total miner holdings at 261,790 BTC. This figure is potentially biased slightly to the downside due to the relatively late start of the North American mining industry, but large inventory flushes like the May 2021 mining ban in China have leveled the playing field for the industry’s active participants. Still, this data is a compelling counterpoint to the figures offered by halving bears.

This bearish line of thinking has gained more traction this time around than in previous cycles: this is in part due to bullish positioning ahead of the halving, a phenomenon that’s never occurred before, making market commentators antsy for a pullback. Paradoxically, these bullish market conditions should lead to less miner liquidation selling, since miners’ margins in a bull market are wider than in a bear market. Miners are highly procyclical actors.

Conclusion

From a structural perspective, there are both bullish and bearish impacts to the market resulting from the halving. By assessing miner flows from an economic perspective and squaring our intuition with data from the blockchain and public miner production updates, we can better understand the changes to market structure stemming from the halving. Overall, given their scale, any impacts from halving-related flows should be vastly outweighed by the event’s memetic impacts and liquidity effects external to the crypto market.