This article presents our thesis on Gnosis DAO (GNO), which we believe is underpriced relative to its assets and operations. In our view, it represents a highly asymmetric investment opportunity.

- Gnosis DAO owns at least $793 million in liquid assets, and 20% of the total supply of SAFE, in addition to a substantial VC portfolio. The value of these assets — whose combined value exceeds the GNO FDV of $1.09B — have been or will be used to return value to GNO holders.

- In the past 12 months, approximately 10% of the GNO circulating supply was bought back by Gnosis DAO. This was one of the largest buyback programs conducted among crypto projects in dollar terms last year.

- GNO provides exposure to a number of high-quality assets, including venture deals from various stages, which most market participants have no direct access to. We believe that the potential of GNO as a proxy bet on its VC book is currently not recognized by the markets. This is especially true for the SAFE token — GNO essentially contains an embedded call option on SAFE given its substantial holdings.

- At least a mid-seven-figure amount of buybacks is scheduled for the next six months, with the actual value likely to be higher.

- Limited transparency in the DAO’s venture deals, uncertainty and delays surrounding the launch of SAFE, and the lack of communication regarding fundamentally important events, such as buybacks, are major reasons for the current misalignment of GNO’s valuation. We believe there are significant improvements in all of these aspects.

Background

Gnosis raised 250k ETH in its 2017 ICO to build a prediction market. However, the Gnosis prediction market saw little adoption, leading the team to start experimenting with other products. In 2020, Arca attempted to compel GnosisDAO to return value to GNO holders, as GNO was trading at 29% of Gnosis DAO’s book value. In response to Arca’s activism, the Gnosis team launched Gnosis DAO and seeded it with 83% of the funds available to Gnosis Ltd. at the time (approximately 150k ETH & GNO tokens).

Gnosis DAO reinvented itself as a venture studio, incubating and spinning off two significant Ethereum protocols: Safe, the most popular smart contract wallet, and CoW Protocol, a decentralized exchange. Both projects were spun off and launched their tokens in early 2022 after GNO token holders voted in favor of these decisions. In return, Gnosis DAO received 20% of the total supply of SAFE tokens and 10% of the total supply of COW tokens. Before spinning off its two main products, Gnosis DAO acquired an asset that has become central to its strategy: POA Network, which was rebranded as Gnosis Chain. Essentially, Gnosis DAO has adopted the business model of ConsenSys, by which it was initially incubated.

After acquiring Gnosis Chain and spinning off Safe and the CoW Protocol, Gnosis DAO continued its incubation activity. Two more products have since been developed under the Gnosis DAO umbrella, Karpatkey and Gnosis Pay. Karpatkey is a self-custodial DAO management service firm with $1.2 billion in AUM, managing treasuries for Gnosis DAO, Balancer, ENS, Aave, and several other DAOs. The last piece of the puzzle is Gnosis Pay, the first self-custodial crypto debit card.

Finally, Gnosis DAO actively engages in venture capital investments. In 2022, the DAO voted to establish an in-house venture capital arm, the VC Factor, which began deploying capital that same year. Recently, however, this activity has ceased and its assets are in the process of being transferred back to Gnosis DAO.

In this report, we will explore value across all these verticals and argue that GNO is severely undervalued.

Treasury

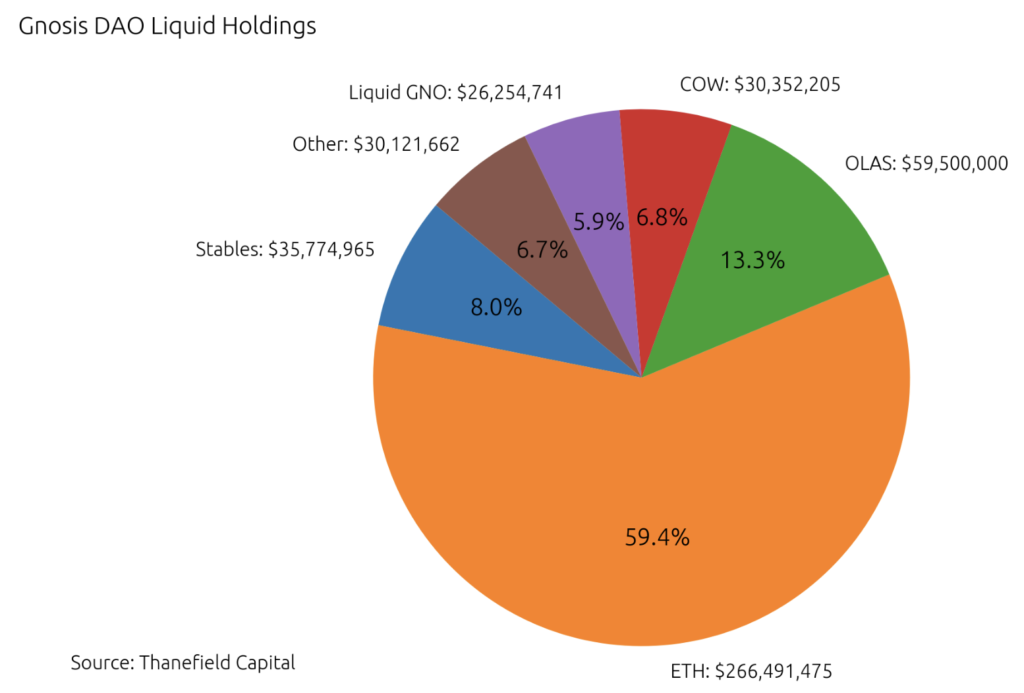

Gnosis DAO possesses one of the largest treasuries of a non-L1 project, with about $793 million in assets. Of this, 44% ($345 million) is in GNO tokens that are not utilized in any way and simply remain on the DAO-controlled wallets. The remaining $448 million, which we will consider as the liquid (or net) treasury, is comprised mostly of ETH, several large altcoin holdings, and various DeFi positions, most of which have GNO and ETH as underlying assets. Leveraging Gnosis DAO’s treasury to return value to GNO holders represents a significant part of the GNO value proposition.

The treasury is professionally managed by Karpatkey, which has a dual mandate: to generate yield for Gnosis DAO, and to develop and grow Gnosis DAO products, in particular Gnosis Chain. These two objectives are broadly synergistic. For instance, Karpatkey proposed and implemented the concept of yield-bearing bridged assets for the Gnosis Chain, a strategy that Blast later utilized for their bridge. This approach enabled Karpatkey to transfer the DAO’s DAI steblecoins to the Gnosis Chain, increasing TVL and activity on the network without sacrificing yield. In 2023, Karpatkey generated $10.2 million in yield for Gnosis DAO.

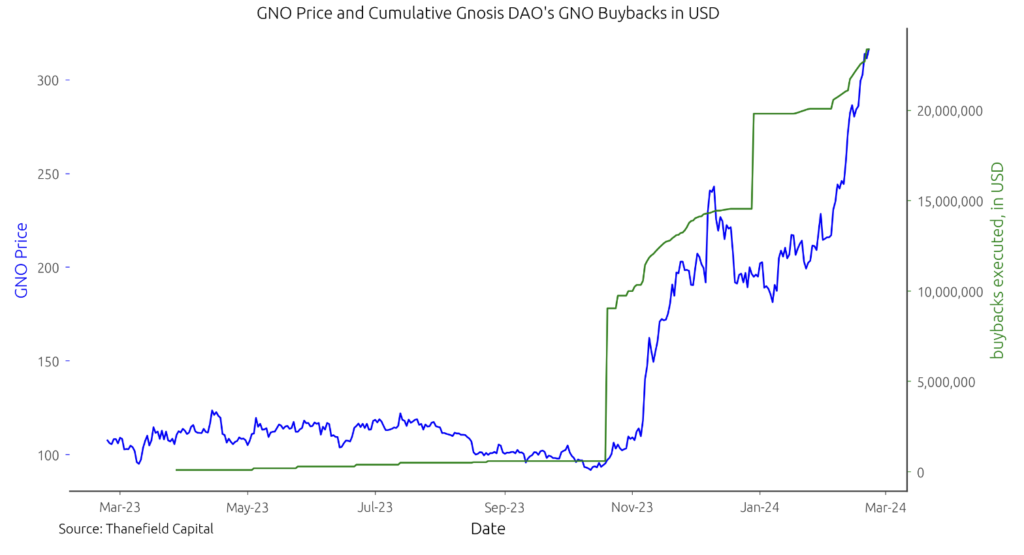

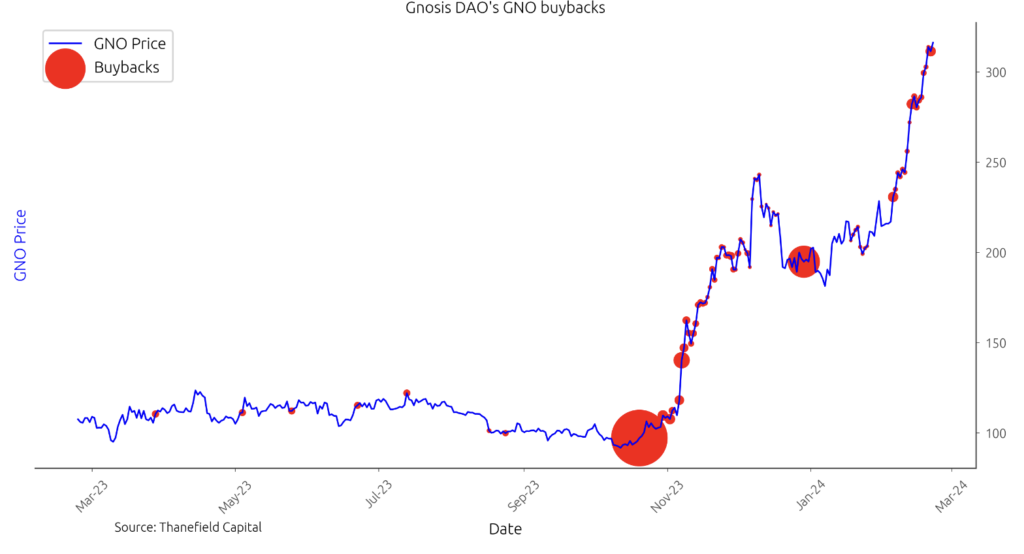

There are 2,589,589 GNO tokens in circulation. This figure is calculated by subtracting approximately 410,000 tokens, vested in the Gnosis Ltd. wallet, from the total supply of 3 million GNO. However, we believe that for Gnosis DAO, the circulating supply should not include GNO tokens held in the DAO’s wallets that are unlikely to enter circulation. A significant portion of the GNO currently owned by the DAO has been acquired through multiple buyback rounds. Below is a chart detailing the GNO acquired in the last year, totaling 169,980 GNO at an average price of $137.5.

Karpatkey conducted buybacks through OTC deals, as well as TWAP and limit orders on CoWSwap. The two large circles on the chart below represent OTC deals. It is also evident that buybacks accelerated in Q4 2023 and continued into 2024.

Given the substantial non-GNO treasury of Gnosis DAO, the fact that Karpatkey continues to conduct buybacks, and its track record of accumulating GNO without selling, we believe that the 959,000 GNO held across four wallets belonging to the Gnosis DAO treasury should not be considered part of the circulating supply. This figure does not include any DeFi positions, except for 60,000 stale GNO supplied across Aave and Spark money markets on Gnosis Chain. These tokens are analogous to the treasury shares of a publicly traded company, which are not considered outstanding.

Considering all of the above, Gnosis DAO’s liquid assets currently amount to approximately $448 million. With a circulating supply of 1.63 million GNO, we estimate its real market capitalization to be $590 million, 37% lower than the $937 million figure reported on CoinGecko and CoinMarketCap.

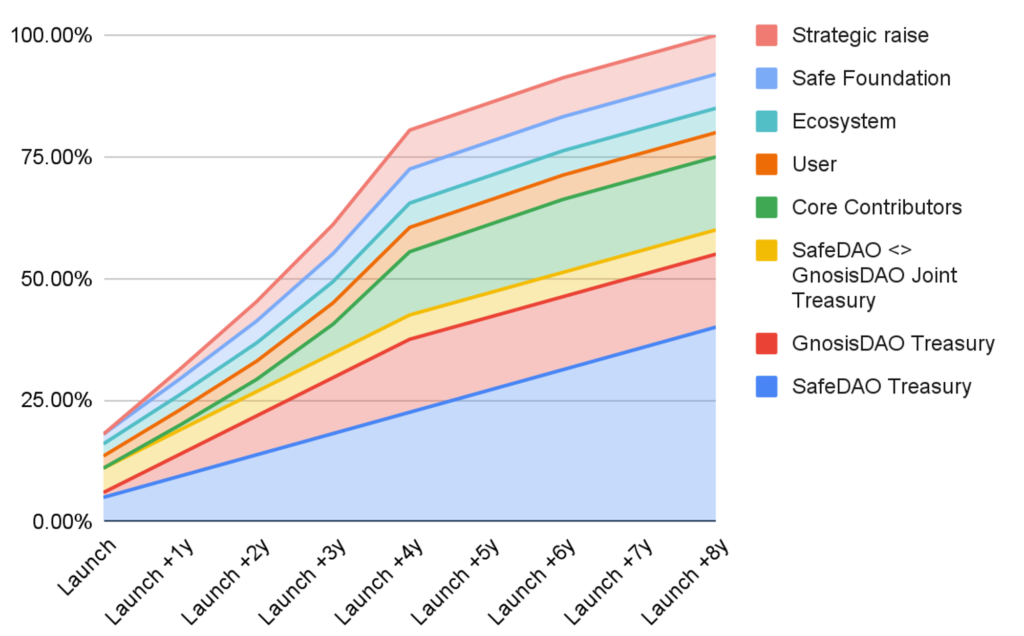

SAFE

Safe is the leading smart wallet, securing more than $90 billion in assets. Incubated and spun off by Gnosis DAO in 2022, the DAO received two token allocations: 15% managed exclusively by Gnosis DAO, and 5% in a joint treasury with Safe DAO. The joint treasury will be fully unlocked once token transferability is enabled. Of the Gnosis DAO’s 15% allocation, 10M out of 150M tokens were unlocked immediately, with the remainder vesting linearly over four years.

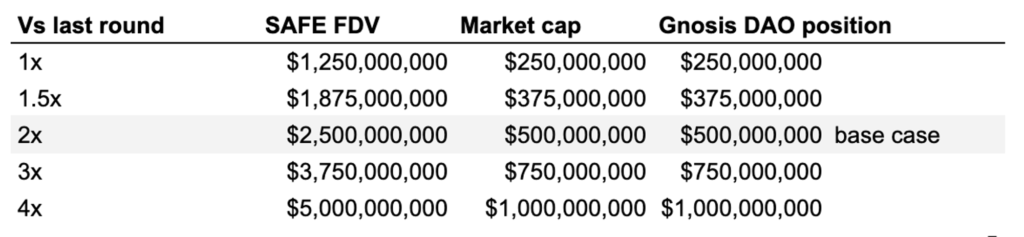

In 2022, Safe announced the completion of a $100 million funding round at a $1.25 billion valuation, led by 1kx. Investors in this round are subject to a one-year lockup and a four-year vesting period – terms less favorable than those granted to Gnosis DAO. While SAFE tokens do not actively trade on OTC markets, we have observed bids to be at a premium to the last funding round.

The token contract has been deployed, but the tokens have remained locked. The Safe DAO has outlined a roadmap with five milestones that must be achieved before the tokens can become transferable, with only the ratification of token utility remaining. This, coupled with the general market sentiment clearly favoring new token launches, makes the likelihood of SAFE launching by the end of Q2 very likely.

As a critical component of Ethereum’s infrastructure, SAFE, with only a 20% float at launch — predominantly owned by Safe DAO — and given its seemingly opportune timing, is anticipated to begin trading at a value higher than its most recent funding round. At a $500 million market cap and $2.5 billion valuation, which is our base case, the Gnosis DAO’s stake in SAFE would exceed the market cap of GNO.

In the spinoff proposal, Gnosis DAO has agreed to own no more than 7% of the circulating GNO supply. This agreement means Gnosis DAO is obliged to either sell SAFE tokens or distribute them to GNO holders via airdrop, in either case effectively embedding a call option on SAFE into GNO. While an airdrop was previously considered the preferable option and was even voted upon, a new strategy proposed by Martin Köppelmann, the co-founder of Gnosis, involves using tokens in the DAO treasury for GNO buybacks. Given that the size of Gnosis DAO’s SAFE position is comparable to GNO’s market capitalization, and the existence of a clear mechanism for returning value to GNO holders, we believe the launch of SAFE represents the most significant short-term catalyst for GNO and could lead to a sharp repricing.

Venture Portfolio

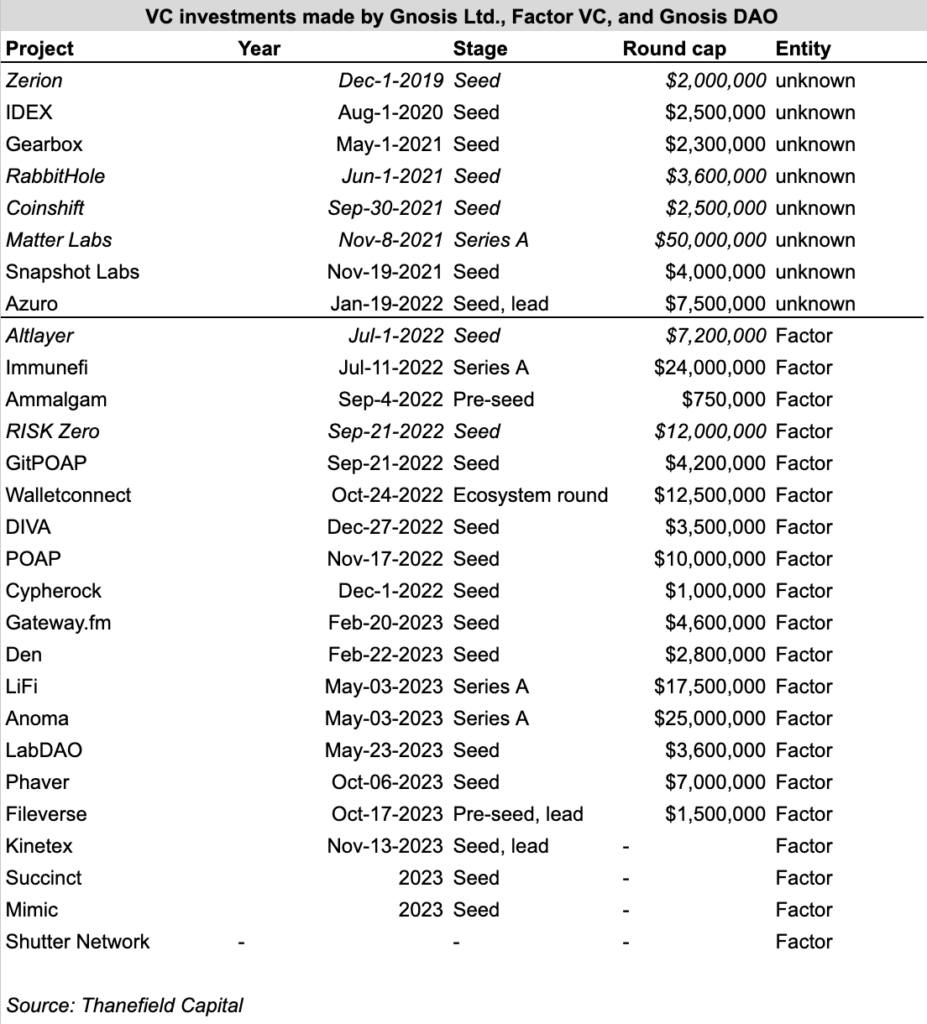

Gnosis has been involved in venture investing since at least 2019. However, a formal VC structure was only established in mid-2022 through the creation and funding of the in-house Factor VC. Before this, venture deals were executed either directly by the DAO or through Gnosis Ltd., a separate entity. Some tokens from deals made by Gnosis Ltd., such as approximately $5 million worth of Gelato tokens (GLT), have been transferred to the DAO.

Factor VC has ceased deploying capital and is in the process of transferring liquid funds to Gnosis DAO. The first tranche, sent on February 18th, consists of approximately $60 million worth of OLAS tokens and roughly $700,000 worth of HOPR tokens. In line with the proposed strategy of utilizing tokens held by the DAO for GNO buybacks, Karpatkey has announced plans to swap $5 million worth of OLAS for GNO using a 6-month long TWAP order. Additionally, $6 million worth of OLAS has been set aside and may be swapped for GNO at Karpatkey’s discretion.

While the VC portfolio represents the least transparent portion of Gnosis DAO’s assets, we have compiled a list of investments for which we have a high degree of confidence were made by one of the Gnosis entities. This list exclusively features tokens that are not found among the assets held in DAO-controlled wallets, and thus, are considered illiquid. Investments made by Factor VC are owned by Gnosis DAO, whereas investments made before July 2022 could be attributed to either Gnosis DAO or Gnosis Ltd, and thus may or may not belong to the DAO.

At the moment, OLAS is one of Gnosis DAO’s largest holdings; however, we believe that the strategy of utilizing the DAO’s tokens acquired through venture deals for buybacks represents another significant value driver for GNO. As depicted in the table, there are several high-quality deals that Factor has participated in. For example, AltLayer, one of the few known Factor investments that got listed on exchanges, is currently trading at approximately 70 times the price the initial investment price.

Gnosis Pay

Gnosis Pay is the Gnosis DAO’s latest project, currently under incubation. Its inaugural product, the Gnosis Card, is a self-custodial Visa debit card that offers users the same user experience as any other Visa card, with the added feature of each transaction being recorded on-chain. The Gnosis Card was launched in Europe in February 2024, and according to on-chain data, 1,850 cards have already been sold. A rollout in additional geographies, including India, Brazil, and the United States, is scheduled for later in 2024.

Gnosis Pay exemplifies how Gnosis DAO has strategically built infrastructure it can now leverage. Built on top of Gnosis Chain, which is well-suited for payments due to its 5-second block time and extremely low transaction fees (500 transactions for $0.01), each Gnosis Pay account operates as an on-chain Safe smart wallet, holding stablecoins to which the user grants allowance for movements. Furthermore, liquidity between EURe – the Euro-denominated stablecoin used in Gnosis Pay – and USD-denominated stablecoins on the chain is provided and managed by Karpatkey on CoW Protocol. Given Gnosis DAO’s significant stake in all these products, we believe the synergies Gnosis Pay creates could be a long-term value driver for the DAO.

Considering Gnosis DAO’s business model and previous behavior, we are confident that Gnosis Pay will eventually be spun off and launch its own token, with Gnosis DAO receiving a significant ownership stake. Among the suite of Gnosis DAO assets, Gnosis Pay represents the most speculative, venture-like, high-risk high-reward bet, backed by an extremely well-funded and connected team with a history of developing and spinning off a number of successful products.

Putting it all together

Gnosis DAO transcends the typical crypto project model of having a single product supported by a treasury. It more closely resembles a holding company and a venture studio, where value is distributed across various verticals and initiatives.

The fact that GNO is trading at only a 32% premium over its liquid treasury value — representing a significant discount when considering its SAFE allocation, and only a fraction of its value when adding its venture portfolio — positions GNO as an exceptionally attractive investment proposition. Moreover, Gnosis Chain and Gnosis Pay, though challenging to put a valuation on, are substantial assets that also belong and governed by GNO holders.

A notable risk in crypto value investing is the lack of intent to return value to holders by the management team. With insiders holding a substantial portion of the tokens, it could be challenging to force these changes through the governance process. A prominent example is Uniswap, which has seen several attempts to activate the fee switch over the years, with some recent progress stemming from proposals by insiders. Despite some concerns regarding aspects of Gnosis DAO’s management — including the transparency issues we’ve highlighted in our recent governance post — it’s clear that Karpatkey recognizes the importance of enhancing GNO’s value. This is clearly evidenced by its actions, including the repurchase of approximately 10% of the outstanding GNO in the last year, as well as by its public statements.

The imminent launch of SAFE stands as the most immediate catalyst. We believe the market will soon recognize that Gnosis DAO serves as a proxy bet on numerous high-quality assets, including ones to which only high profile VCs have access. Consequently, we think that GNO should, at the very least, trade in line with its liquid portfolio, plus a reasonable estimation of its venture holdings, which provides a substantial upside to the current valuation.