This is an update on our thesis on Gnosis DAO (GNO) following several significant developments since our initial publication less than two weeks ago.

Summary

- The team has disclosed the assets of both Gnosis DAO and Gnosis Ltd., with plans to merge these portfolios for the benefit of GNO and the Gnosis DAO community. This resolves a previously uncertain aspect in a manner that greatly favors GNO holders.

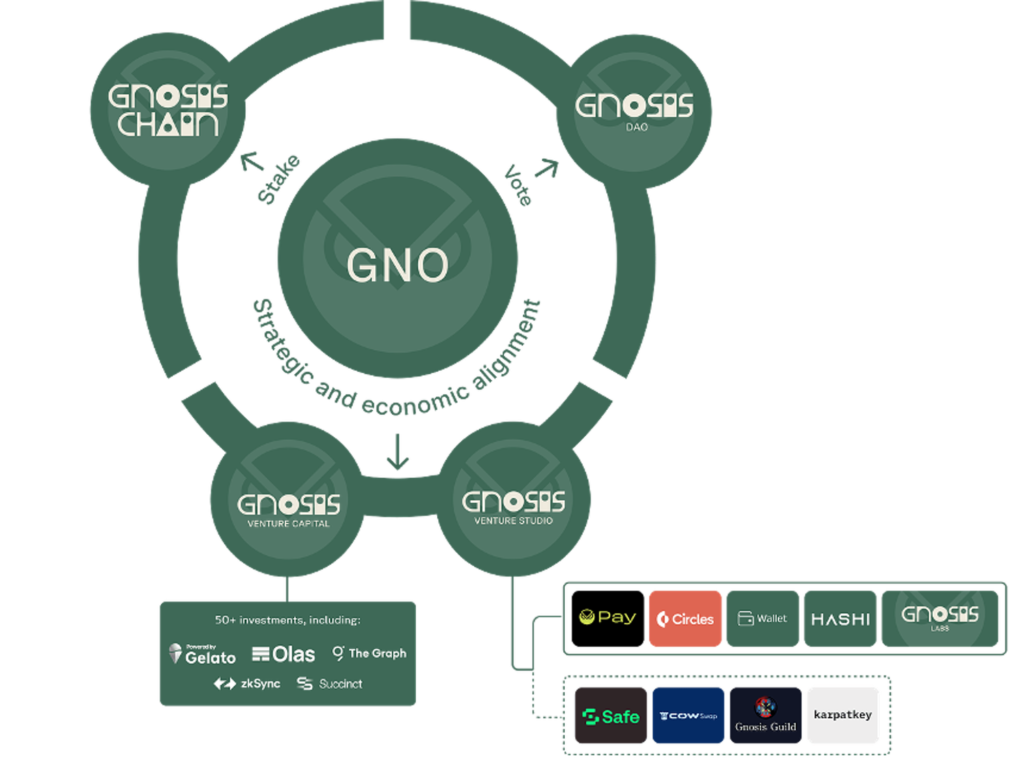

- Gnosis 3.0 was introduced, positioning GNO at the heart of the Gnosis DAO’s activities by enhancing value return and incentive alignment. Furthermore, Gnosis 3.0 signifies a strategic pivot from infrastructure development to a focus on consumer payment products, highlighted by the announcement of the Gnosis Wallet, an on-chain neobank that the Gnosis DAO team has been developing for some time.

- The anticipated launch of the SAFE token, which we view as a crucial immediate catalyst for GNO, has been moved up from “the end of Q2” to a specific date: April 23rd.

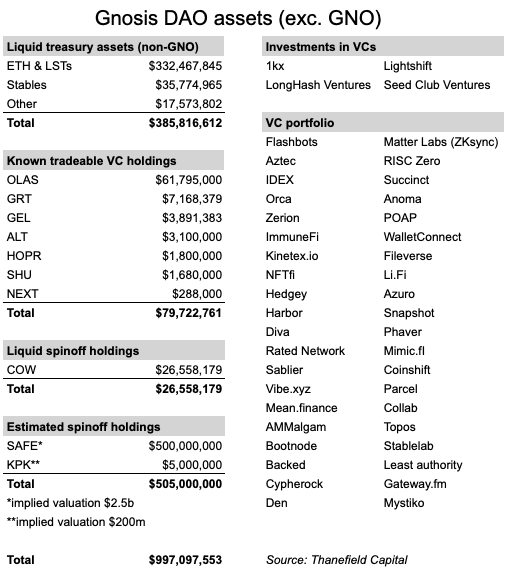

Gnosis DAO assets & ownership structure

The original thesis was clouded by uncertainty regarding the investment portfolio and ownership structure of Gnosis Ventures. Over the years, investments were made through various entities, including Gnosis DAO, Gnosis Ltd., a separate entity not under control of the token holders, and Factor VC, the in-house venture capital arm. The team has now clarified the situation by disclosing the complete list of investments made by both Factor VC and Gnosis Ltd. Moreover, the team has announced plans to transform Gnosis Ltd. into a foundation aimed at promoting the Gnosis ecosystem. It has been confirmed that the assets of the newly established foundation, particularly liquid ones, will be treated in the same manner as the existing assets of Gnosis DAO, thereby enhancing the value returned to GNO holders.

The assets that will come under DAO management after Gnosis Ltd.’s transformation into a foundation exceed our initial estimates. This is because the previously opaque structure concealed some transactions. In addition to direct token and equity investments, Gnosis Ltd. has also placed funds in four other allocators, effectively operating as a fund of funds.

Although the updated list still lacks precise figures and makes certain assumptions — making it difficult to quantify the value on the right side of the list — it represents a significant improvement over what was available two weeks ago and has exceeded expectations.

The FDV of GNO stands at $1.09 billion. However, by subtracting the tokens already owned by the DAO — an approach we consider to be the correct method for valuing GNO — the market capitalization is adjusted to $660 million.

Gnosis 3.0

The Gnosis 3.0 vision solidifies what has until now been largely theoretical and experimental: positioning GNO at the core of all Gnosis DAO activities. This is achieved by deploying proceeds from its venture investments and venture studio (i.e., the VC portfolio discussed earlier) to buy back GNO tokens and use them in liquidity provisioning, effectively transforming GNO into an index for the Gnosis DAO ecosystem. The direct mechanism for returning value to GNO holders, combined with the value of the liquid/venture portfolio alone, leads us to believe that the index is currently undervalued.

Furthermore, there is an upcoming proposal aimed at establishing a new framework for VC investments within Gnosis DAO. This initiative is designed to secure GNO’s central role within the growing Gnosis ecosystem over the long term.

Gnosis 3.0 is shifting its focus towards payments and the development of new customer-centric financial products, leveraging the infrastructure it has already established, including Safe, Gnosis Chain, and CoW Protocol. The introduction of Gnosis Pay and its first product, the Gnosis Card — a pioneering non-custodial crypto debit card with all transactions recorded on-chain — was already known. However, a recent forum post disclosed the team’s work on a much more ambitious project: a comprehensive, mobile-first banking solution built on open and decentralized platforms, encompassing Safe, Gnosis Pay, Circles, and other offerings like CoW. This platform, described as onchain neobank, aims to provide a seamless experience for users to spend, swap, and remit funds onchain, for anyone familiar with mobile banking. This product, named Gnosis Wallet, is set to be officially announced and launched shortly.

While it’s challenging to place a monetary value on newer Gnosis DAO products like Gnosis Pay and Gnosis Wallet due to the lack of comparable market products, it’s evident that if a team with a similar track record were to seek funding for a comparable product at a similar development stage today, this project would have a nine-figure valuation.

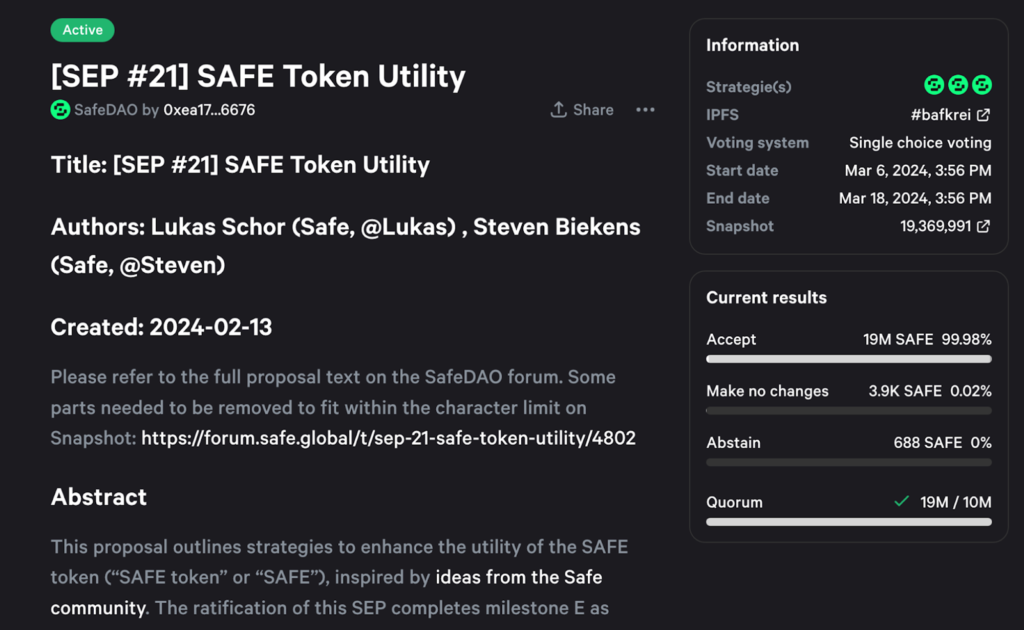

SAFE update

The SAFE token transferability is an important event for GNO, as Gnosis DAO holds 20% of SAFE’s total supply — 15% directly and an additional 5% in conjunction with Safe DAO. This event serves two critical purposes. Firstly, it will assign a tangible dollar value to one of Gnosis DAO’s major assets, which has largely been underestimated up to now. Secondly, upon the commencement of transferability, Gnosis DAO will immediately unlock 1% of the total SAFE supply, representing a value in the eight-figure range. In line with the Gnosis 3.0 strategy, it would be a prudent move to redistribute some of this value back to GNO holders through TWAP mechanisms and liquidity provisioning.

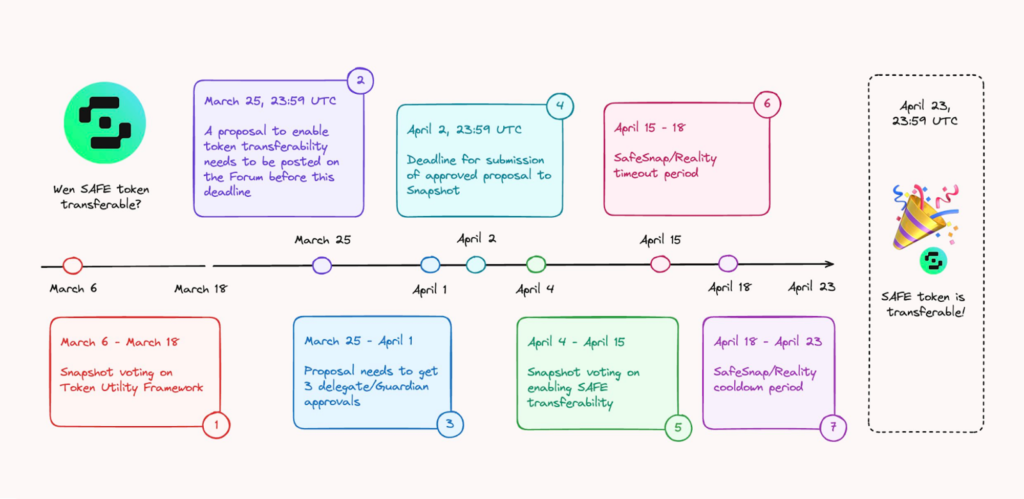

As outlined in the initial analysis, out of the five milestones necessary before initiating a vote on SAFE transferability, only one remains: the ratification of SAFE utility. Progress has been made, and the vote on this final milestone commenced, with an anticipated conclusion on March 18th.

The successful completion of this vote removes the final hurdle for initiating the vote on SAFE token transferability. According to the governance process outlined by SAFE, the most probable sequence of events leading to transferability is now set in motion, culminating in the activation of transferability on April 23rd.

Credits to @danftz on X for infographic

Final words

The latest updates reinforce our $GNO thesis as a bet on Gnosis DAO’s extensive asset portfolio, which includes liquid assets, assets nearing liquidity, — such as SAFE and various other prime VC investments, — and long-term, hard-to-value assets, such as Gnosis Chain, Gnosis Pay, and Gnosis Wallet.

With nearly a billion dollars in quantifiable assets — excluding the majority of VC investments, fund of funds activity, and in-house products — and a $660 million market capitalization that doesn’t account for $GNO already held by the DAO, we maintain that $GNO is significantly undervalued.